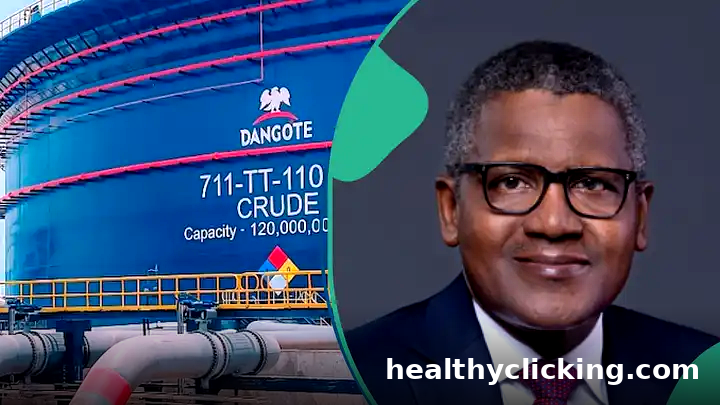

In 2025, Nigeria’s Dangote Refinery, a massive 650,000 barrels-per-day facility, was expected to transform the nation’s energy landscape by reducing reliance on imported fuel. However, despite its operational status, Nigeria continues to import petrol. This paradox raises questions about the refinery’s pricing strategies, market dynamics, and the broader implications for Nigeria’s energy security.

The Promise of the Dangote Refinery

The Dangote Refinery was envisioned as a solution to Nigeria’s chronic fuel importation problem. With its substantial capacity, it aimed to meet domestic demand, stabilize prices, and position Nigeria as a net exporter of refined petroleum products. The refinery’s establishment was also seen as a strategic move to conserve foreign exchange and create jobs.

Crude Oil Price Fluctuations and Petrol Pricing

Global crude oil prices have experienced significant volatility. For instance, between April 1 and 9, 2025, the Eurobob M1 swap, a benchmark for petrol prices, dropped from $734.25 per metric ton to $603 per metric ton, marking a 17.9% decrease. In response, Dangote Refinery reduced its ex-depot petrol price marginally from N880 to N865 per litre, a 1.7% decrease. This modest adjustment contrasts sharply with the significant drop in crude oil prices, leading to questions about the refinery’s pricing model.

Importation of Petrol Persists

Despite the refinery’s operations, Nigeria continues to import petrol. Marketers argue that imported petrol is often cheaper than the refinery’s offerings. For example, in late 2024, Dangote’s petrol was priced between N1,015 and N1,028 per litre, while the landing cost of imported petrol was approximately N978.01 per litre. This price discrepancy incentivizes marketers to favor imports over local purchases.

Challenges Facing the Refinery

Several factors contribute to the refinery’s pricing challenges:

-

Crude Oil Sourcing: The refinery has faced difficulties in securing crude oil locally, leading to reliance on imports, which are more expensive due to transportation and logistics costs.

-

Currency Fluctuations: The refinery purchases crude oil in US dollars but sells petrol in Nigerian naira. This mismatch exposes the refinery to foreign exchange risks, affecting pricing stability.

-

Operational Costs: High operational and maintenance costs, coupled with the need to recoup the substantial investment in building the refinery, influence the pricing of its products.

Government’s Role and Strategic Reserves

In response to fuel supply challenges, the Nigerian government plans to establish a national strategic petroleum products stockpile. This initiative aims to cushion the economy against global supply disruptions and ensure energy security. The stockpile will leverage Nigeria’s growing domestic refining capacity, including the Dangote Refinery and other smaller facilities.

Conclusion

The Dangote Refinery holds the potential to revolutionize Nigeria’s energy sector. However, pricing strategies, crude oil sourcing challenges, and market dynamics currently hinder its ability to displace fuel imports fully. Addressing these issues requires coordinated efforts between the refinery, government, and other stakeholders to realize the vision of energy self-sufficiency and economic stability.

78f2j7