the Federal Capital Territory Administration’s (FCTA) renewed commitment to enforcing land use regulations, an Access Bank branch located in the bustling commercial hub of Wuse, Abuja, was sealed on May 26, 2025, due to non-payment of ground rent spanning an astonishing 34 years. This dramatic action, which has sent ripples through Abuja’s business community, is part of a broader crackdown by the FCTA targeting property owners across the city’s prime districts, including Wuse, Maitama, and Asokoro, for failing to settle outstanding ground rent obligations totaling a staggering ₦6.97 billion.

The Backstory: A 34-Year Debt

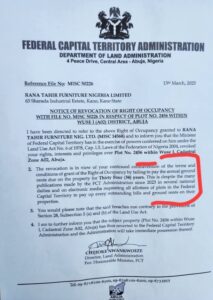

The sealed property, situated in the heart of Wuse, a vibrant area known for its commercial significance, is officially allocated to Rana Tahir Furniture Nigeria Limited, not Access Bank directly. However, the bank, a prominent tenant operating on the premises, has found itself at the center of this controversy. According to the FCTA, the property owners failed to pay ground rent for over three decades, accumulating a significant debt that prompted the authorities to invoke the Land Use Act. This legislation empowers the FCTA to revoke titles and seal properties for non-compliance with statutory obligations, such as ground rent payments, which are critical for maintaining the financial and administrative framework of the Federal Capital Territory.

Ground rent, a recurring fee paid by property owners to the government for the use of land, is a legal requirement in Nigeria. Failure to pay can result in penalties, including the revocation of land titles. In this case, the FCTA’s action against the Wuse property highlights a long-standing issue of non-compliance that has plagued Abuja’s real estate sector. The 34-year delinquency underscores the challenges the FCTA faces in ensuring property owners meet their financial obligations, especially in high-value districts where land is a prized asset.

The Impact on Access Bank and the Community

While the property is technically owned by Rana Tahir Furniture Nigeria Limited, the sealing of the Access Bank branch has significant implications for the bank and its customers. Access Bank, one of Nigeria’s leading financial institutions, is a key player in the country’s banking sector, and the closure of one of its branches in a prime location like Wuse is likely to disrupt operations and inconvenience clients. The branch, located in a busy commercial district, serves a diverse clientele, including businesses, professionals, and residents, who rely on its services for daily financial transactions.

The sealing of the branch has sparked discussions about the responsibilities of tenants versus property owners in such disputes. While Access Bank may not be directly liable for the ground rent, its operations have been affected by the actions of the property owner. This situation raises questions about the due diligence processes of major corporations when leasing properties and the potential risks of associating with landlords who fail to meet statutory obligations.

For the Wuse community, the closure is a stark reminder of the FCTA’s authority and its willingness to take decisive action. Wuse is a commercial nerve center, home to numerous businesses, markets, and offices, and any disruption in this area can have a ripple effect on the local economy. Residents and business owners in the area are now watching closely to see if more properties will face similar consequences.

What’s Next?

The sealing of the Access Bank branch is likely just the beginning of the FCTA’s enforcement efforts. The agency has signaled its intent to continue targeting properties with outstanding debts, and more high-profile closures could be on the horizon. For property owners across Abuja, this serves as a wake-up call to settle their ground rent obligations or risk losing their titles.

For Access Bank and Rana Tahir Furniture Nigeria Limited, the immediate priority will be resolving the issue with the FCTA to reopen the branch and restore normal operations. This may involve negotiating a payment plan for the outstanding ground rent or addressing any underlying disputes over the property’s title. In the meantime, the bank’s customers may need to rely on alternative branches or digital banking services, which could strain operations in the short term.

Join our Whatsapp channel to stay updated always!